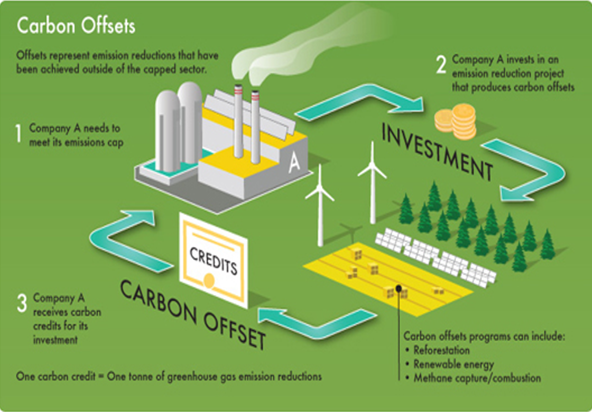

Carbon offsets are tradable rights that are tied to specific activities that reduce CO2 emissions. The money that these offsets provide is used to fund projects that fight climate change. By purchasing carbon offsets, companies and individuals can fund projects that reduce emissions from their own business. Offsets can be purchased through a broker. You can easily invest in carbon through Axsess.io.

What is the main idea behind carbon credits?

Carbon credits are important because they offer businesses a green alternative to polluting. They provide “additionality,” which means that they are “good for the environment.” These credits are obtained by projects such as planting trees and preventing other sources of CO2 emissions. Many carbon projects are based on questionable practices, however.

Why do companies buy carbon credits?

Companies like Axsess Exchange that purchase carbon credits are required to disclose their greenhouse gas emissions. These companies are also required to set goals and targets for reducing their emissions. By purchasing carbon credits, they can avoid having to pay fines to the government or other organizations for emitting more greenhouse gases than their quota. Companies can also use the credits to offset residual emissions.

What are the benefits of carbon credits?

Carbon credits are a real and tangible way of reducing carbon emissions. The EU is working to implement a trading system which will allow companies to buy and sell carbon credits on the European market.

The market for carbon credits is growing rapidly as governments and corporations seek to reduce their carbon footprint. These markets are administered by institutions such as the UN, World Bank and the European Union, who have created protocols to allow anyone to participate.

If we can make a positive impact on the environment by reducing our carbon footprint, why not donate carbon credits as a form of charity?

Carbon credits are becoming an increasingly important part of the climate change solution. More companies have pledged to reduce their emissions in order to prevent global warming. However, many companies are unable to make the necessary reductions quickly or completely. Even with these efforts, companies will need carbon offsets to balance their emissions.

Carbon credits are increasingly important as energy usage continues to rise. With the Paris Agreement coming into effect in 2020, companies will face more pressure to be responsible for their climate impact. Additionally, the market is growing, with new buyers coming to the market every day. In addition, carbon pricing programs are becoming more widely available, which will increase the amount of carbon credits that companies can buy.

Carbon Offsets and Climate Action

Carbon credits are a great way to offset emissions and set goals with peers. However, they have limitations and should be used responsibly. They must be transparent, verifiable and environmentally sound. And they should be priced competitively and efficiently. This is not an easy task, and a voluntary market is necessary to make the market work effectively.

Carbon credits are used as a tool in climate action, but it must be understood that these credits can help or hurt progress. To be successful, companies and countries must commit to ambitious decarbonization plans aligned with the Paris climate agreement. Furthermore, high-integrity carbon credits must be sold in proportion to the reductions made in the past. This means that only high-quality credits can reach the market. In the near future, this will be crucial for reducing emissions and funding a low-carbon future.

Who are the buyers of carbon credits?

Carbon credits are a way to buy carbon emissions reduction. Governments, industry and other stakeholders like Axsesshave started buying carbon credits which can help them cut down on the amount of carbon dioxide they emit by 20% or more.

Carbon credits have become a lucrative business, and there are many examples of companies that have bought them. For example, Royal Dutch Shell recently delivered a tanker-load of LNG to Taiwan, which is labelled as carbon-neutral. The company has also invested in forest projects in Ghana, Indonesia, and Peru, which are decades old. This helps ensure that the company’s environmental impact is minimized. There are a variety of reasons why companies buy carbon credits.

Carbon credits prices vary significantly. They can range from under a dollar to over $150 per ton. The price per ton of carbon credits will depend on the type of project you choose and the price of carbon credits on the market. Currently, the market for carbon offsets is worth just a few hundred million dollars.